Trump administration moves to cut federal benefits for illegal immigrants amid border crisis

12/02/2025 / By Belle Carter

- The Trump administration plans to eliminate federal tax benefits—including refundable credits like EITC and Child Tax Credit—for illegal immigrants and non-qualified aliens, citing concerns over welfare abuse and immigration enforcement.

- Treasury Secretary Scott Bessent announced the move, framing it as protecting taxpayer resources for U.S. citizens, while Trump warned of unsustainable welfare burdens tied to mass migration.

- Despite the 1996 Welfare Reform Act restricting non-citizen access to benefits, tax credit loopholes have allowed undocumented individuals to receive refunds—critics argue this incentivizes illegal immigration.

- The policy aligns with Trump’s crackdown on migration, including deportations, stricter “public charge” rules and reversing Biden-era border policies amid record-high illegal crossings.

- Supporters praise fiscal responsibility, while opponents warn of humanitarian consequences, as immigration remains a central issue in the U.S. political scene.

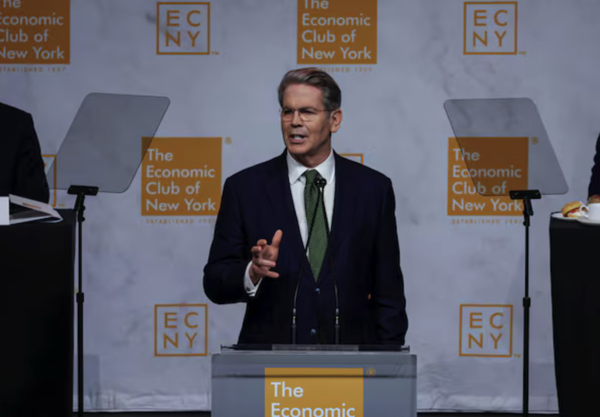

In a sweeping policy shift, Treasury Secretary Scott Bessent announced Friday, Nov. 28, that the Trump administration is preparing to cut off federal tax benefits for illegal immigrants and other non-qualified aliens.

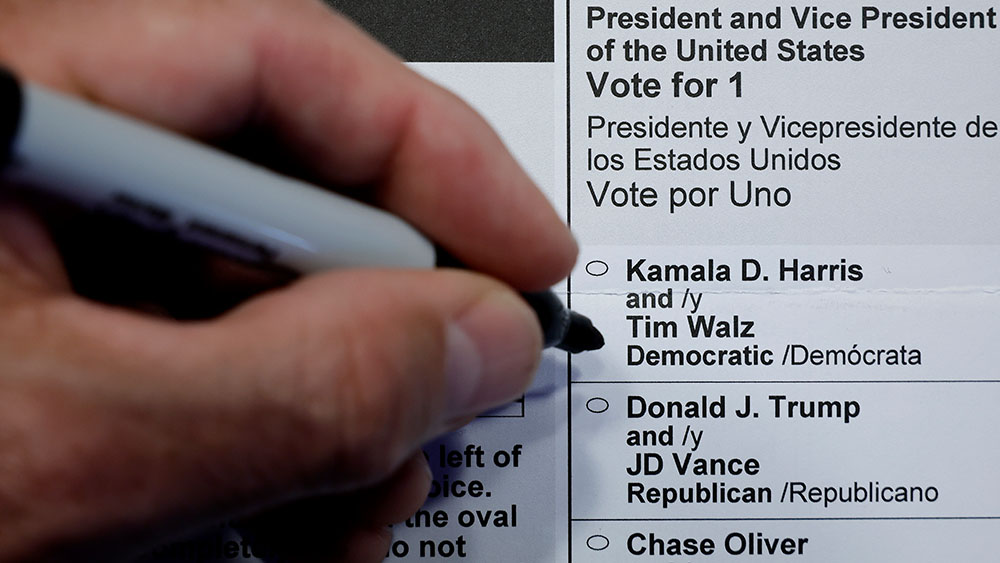

The move, directed by President Donald Trump, targets refundable tax credits—including the Earned Income Tax Credit (EITC), Additional Child Tax Credit, American Opportunity Tax Credit and Saver’s Match Credit—that have been accessible to undocumented individuals. The announcement comes amid escalating concerns over illegal immigration, with Trump warning of a “nation-killing” crisis fueled by open borders and unsustainable welfare burdens.

The Department of the Treasury‘s proposed regulations aim to clarify that refundable tax credits—which provide cash payments to low-income households—will no longer be available to those without legal immigration status.

“At @POTUS @realDonaldTrump’s direction, we are working to cut off federal benefits to illegal aliens and preserve them for U.S. citizens,” Bessent posted on X (formerly Twitter).

The decision follows Trump’s lengthy Thanksgiving Day post decrying the economic and social strain caused by mass migration. He claimed that the U.S. foreign-born population has reached 53 million, many of whom rely on welfare, exacerbating issues like crime, overcrowded hospitals and housing shortages.

“A migrant earning $30,000 with a green card will get roughly $50,000 in yearly benefits for their family,” Trump wrote. “This refugee burden is the leading cause of social dysfunction in America.”

Historical context: Immigration and welfare policy

The debate over taxpayer-funded benefits for undocumented immigrants is not new. According to BrightU.AI‘s Enoch, federal law has restricted non-citizens’ access to welfare programs since the 1996 Welfare Reform Act. However, loopholes—particularly in tax credits—have allowed some undocumented workers to receive refunds despite paying little or no income tax. Critics argue this incentivizes illegal immigration, while advocates claim these benefits support vulnerable families contributing to the economy.

Trump’s latest move aligns with his broader immigration agenda, which includes pausing migration from “Third World countries,” deporting public charges and reversing Biden-era admissions. His administration previously sought to expand the “public charge” rule, denying green cards to immigrants likely to rely on government assistance.

The Treasury’s action signals a tightening of fiscal controls as border crossings surge. Under former President Joe Biden, illegal entries have skyrocketed, with monthly apprehensions exceeding 300,000 at times—a stark contrast to Trump’s final year, when daily crossings dropped to 500-600. Border officials report arresting individuals from 180 countries, including potential security risks.

Trump’s rhetoric has intensified ahead of the 2024 election, framing immigration as an existential threat. “Only REVERSE MIGRATION can fully cure this situation,” he declared, vowing to deport those who “undermine domestic tranquility.”

The Treasury’s crackdown on tax benefits marks another front in the Trump administration’s immigration battle. While supporters applaud fiscal responsibility, opponents warn of humanitarian fallout. The debate over welfare, borders and national identity still dominates the political scene—with millions of lives hanging in the balance.

Watch the video below that talks about California funding illegal aliens’ healthcare over the state’s own police.

This video is from the BehindTheLinePodcast channel on Brighteon.com.

Sources include:

Submit a correction >>

Tagged Under:

Additional Child Tax Credit, American Opportunity Tax Credit, Bessent, Biden, big government, border crisis, border security, debt bomb, debt collapse, Earned Income Tax Credit, federal benefits, government debt, green card, illegal immigration, invasion usa, migrants, national security, Open border, Open Borders, progress, Saver's Match Credit, taxpayer resources, Trump

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 INVASIONUSA.COM

All content posted on this site is protected under Free Speech. InvasionUSA.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. InvasionUSA.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.